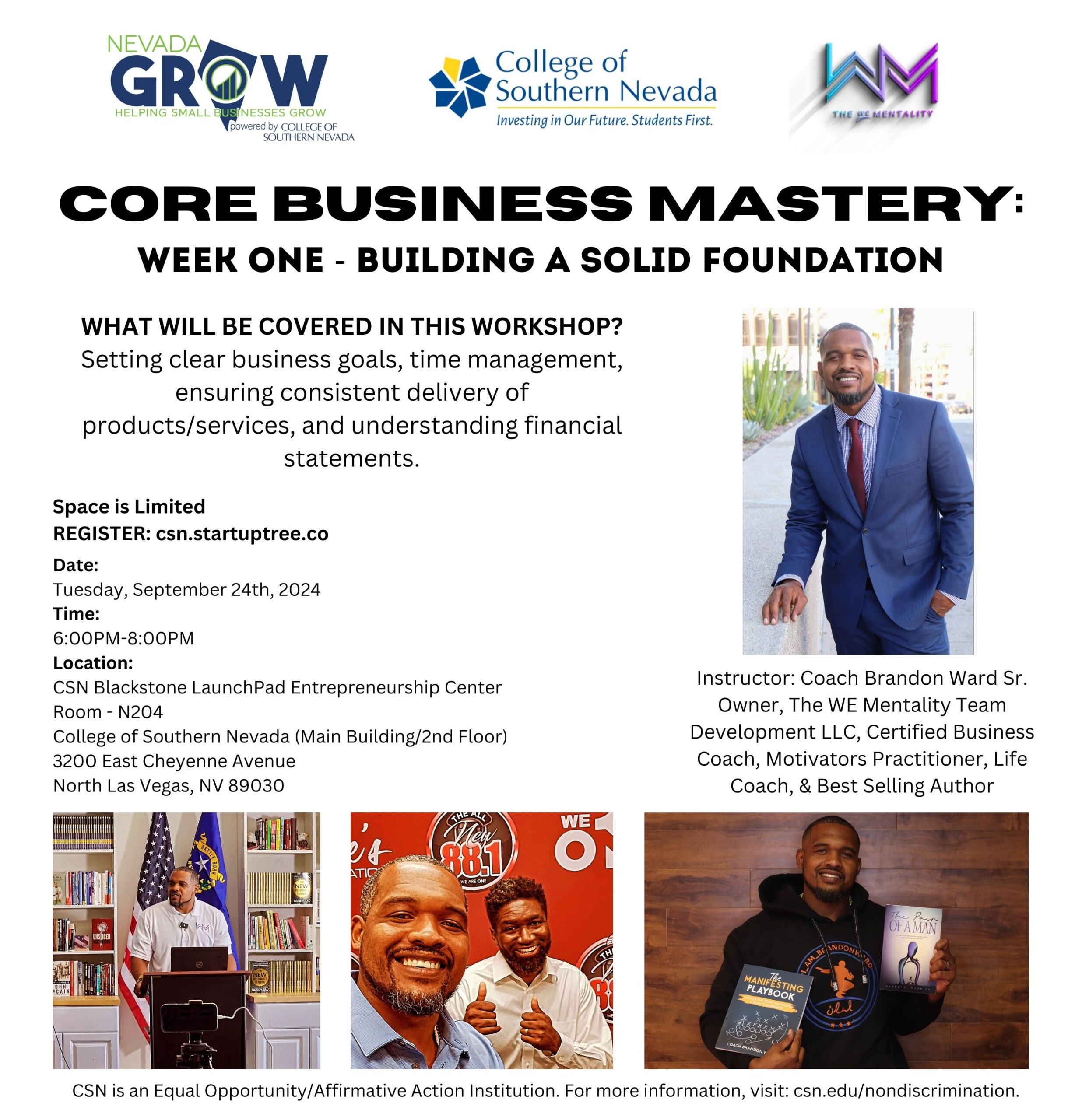

Core Business Mastery – Week One – Building a Solid Foundation

CSN Blackstone LaunchPad Entrepreneurship Center Room 3200 East Cheyenne Avenue North Las Vegas, NV 89030, North Las Vegas, United StatesWHAT WILL BE COVERED IN THIS WORKSHOP? Setting clear business goals, time management, ensuring consistent delivery of products/services, and understanding financial statements.